The Richest Countries in North America 2025

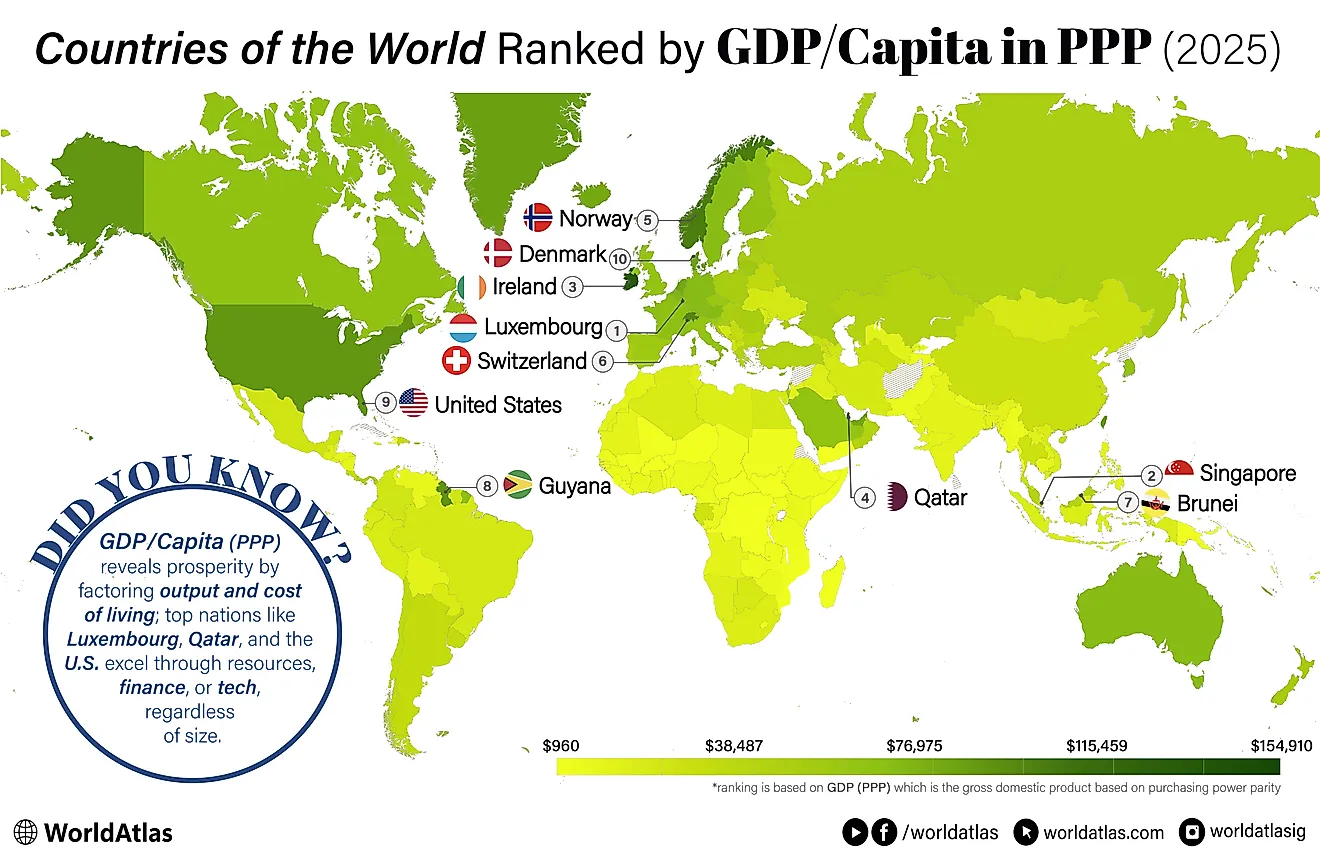

Using the latest 2025 IMF estimates, North America reveals a fascinating split-screen when it comes to GDP per capita (PPP): towering continental economies on one side, and nimble Caribbean and Central American states on the other, each prospering in very different ways.

At the top sits the United States, whose huge, innovation-driven marketplace still translates into the region’s highest living-standard figure, about $89,100 per person. Canada follows, leveraging abundant natural resources, advanced services, and a technology sector that punches above its population weight, to notch roughly $65,700. Yet the surprise storyline lies farther south. Panama’s role as the Western Hemisphere’s shipping toll-booth and financial conduit lifts it to third place, while tourism-centric island nations such as The Bahamas and Trinidad & Tobago parlay strategic geography, offshore banking, and energy exports into per-capita incomes that rival parts of Western Europe.

In 2025, the richest countries in North America are the United States, Canada, and Panama, with GDP/Capita (PPP) of $89,598, $65,500, and $43,651, respectively. The ten leaders profiled below illustrate how a mix of geography, policy choices, and sectoral specialization can propel economies, large or small, to the very top of the regional wealth table in 2025.

10 Richest Countries In North America

| Rank | Country | GDP/Capita in USD (PPP) |

|---|---|---|

| 1 | United States | $89,598 |

| 2 | Canada | $65,500 |

| 3 | Panama | $43,651 |

| 4 | The Bahamas | $42,002 |

| 5 | Trinidad and Tobago | $35,899 |

| 6 | Saint Kitts and Nevis | $34,096 |

| 7 | Costa Rica | $31,485 |

| 8 | Antigua and Barbuda | $31,380 |

| 9 | Dominican Republic | $30,537 |

| 10 | Saint Lucia | $29,257 |

Jump to the list of all North American countries ranked by GDP/Capita (PPP)

1. United States - $89,598 GDP/Capita (PPP)

The United States tops North America’s 2025 wealth league with an IMF-projected GDP per capita (PPP) of about $89,600. Its prosperity rests on a diversified, high-productivity mixed economy that blends cutting-edge technology, finance, and creative industries with vast energy and agricultural assets. The U.S. accounts for roughly a quarter of global nominal output; its dollar underpins international reserves and trade, reinforcing access to capital.

Competitive advantages include world-class universities, a dynamic venture-capital ecosystem, and the globe’s largest consumer market, which typically fuels about two-thirds (68%) of GDP. Robust transport and logistics networks support the region’s largest exporter by value, the U.S.; large domestic oil and gas production helps keep energy costs relatively low by advanced-economy standards. However, the country pairs exceptional average incomes with one of the OECD’s widest inequality gaps and a rising public-debt burden. Even so, steady growth, flexible labor markets, and continual innovation keep the United States firmly at the pinnacle of North American living standards.

2. Canada - $65,500 GDP/Capita (PPP)

Canada secures the No. 2 spot in North America’s 2025 wealth rankings with an IMF-estimated GDP per capita (PPP) of about $65,500. A highly diversified, export-oriented mixed economy and top-10 global player by nominal GDP, Canada marries abundant natural resources with world-class services. Oil sands, hydro power, and critical minerals make it a significant net energy exporter, while the Prairies feed global grain markets and Ontario-Québec anchor a sophisticated auto, aerospace, and technology corridor.

Trade remains the growth engine: merchandise and services flows totaled about $2 trillion (USD-equivalent; well above C$2T) in 2024, with the United States absorbing roughly three-quarters of exports, and more than a dozen FTAs covering 50 economies expanding access. Low corruption, strong institutions, cooperative banking, and a robust social-security net underpin stability; the Toronto Stock Exchange, one of the world’s ten largest by market cap, channels investment. Despite housing-affordability strains and middling productivity, steady immigration, competitive innovation clusters, and prudent fiscal management keep Canada firmly positioned among the continent’s high-income leaders heading into the latter half of the decade.

3. Panama - $43,651 GDP/Capita (PPP)

Panama claims North America’s third-highest living-standard slot for 2025, with an IMF-estimated GDP per capita (PPP) of about $43,651. The isthmus leverages geography and full dollarization to run a service-heavy, outward-looking economy: finance, insurance, medical tourism, and the Colón Free Trade Zone account for around three-quarters of output, while the expanded Panama Canal and several large container terminals on both coasts anchor a regional logistics hub connecting Atlantic and Pacific trade lanes.

Long-run growth has been strong, but it slowed markedly in 2024-2025 as the Cobre Panamá mine shutdown and canal drought constraints weighed on activity. Diversified light manufacturing (cement, beverages, aircraft parts) and niche agro-exports (bananas, shrimp, coffee) round out the mix. Credit ratings are mixed after a 2024 downgrade by one major agency, but conservative banking regulation and dollarization help keep inflation low. Prosperity remains uneven: rural and Indigenous provinces face poverty rates multiple times urban levels, and income inequality is among the widest in Latin America, tempering Panama’s headline wealth story.

4. The Bahamas - $42,002 GDP/Capita (PPP)

The Bahamas enters North America’s 2025 wealth table in fourth place, with an IMF-estimated GDP per capita (PPP) of about $42,003. Tourism is the undisputed engine: visitor spending, resort construction, and cruise-ship traffic together generate around half of output and support roughly half of employment when direct and indirect effects are included. A dollar-pegged currency and English-speaking workforce have also nurtured an offshore financial centre, contributing low-teens percent of GDP, though stricter tax-transparency standards have trimmed licences lately.

Beyond hotels and finance, the archipelago’s economy is thin: agriculture, fishing, and light industry add roughly a tenth of output, and the vast majority (often 80-90%) of food is imported, leaving the country vulnerable to supply disruptions. A zero-income-tax regime, funded largely by a 10% VAT and tourism levies, keeps the fiscal burden low but leaves public coffers exposed to external shocks, especially swings in U.S. visitor demand, hurricanes, and climate risk. Even so, political stability, high per-capita wealth, and ongoing resort investment anchor The Bahamas among the region’s richest economies.

5. Trinidad and Tobago - $35,899 GDP/Capita (PPP)

Trinidad and Tobago ranks fifth on North America’s 2025 wealth table, with an IMF-estimated GDP per capita (PPP) of about $35,900. The twin-island republic is unique in the English-speaking Caribbean for its export-oriented industrial base built on offshore oil and especially natural-gas reserves. Energy and downstream petrochemicals provide roughly a third of GDP and about four-fifths of exports, sustaining a steady trade surplus. Large LNG, ammonia, and methanol complexes make the country a major global supplier of ammonia and methanol, and a significant LNG exporter in the Americas.

Hydrocarbon revenues have financed solid infrastructure and a sophisticated banking sector, leaving T&T with one of the highest income levels in the Caribbean and LAC region, even though the industry directly employs only a low single-digit share of workers and leaves the budget exposed to price swings. Policy now targets diversification into downstream chemicals/plastics, logistics, digital and creative industries, and tourism, while strengthening Port of Spain’s role as a regional financial hub. If gas output improves as planned, low-single-digit growth (2%) should help keep Trinidad and Tobago in the high-income bracket, barring commodity or supply shocks.

6. Saint Kitts and Nevis - $34,096 GDP/Capita (PPP)

Saint Kitts and Nevis maintains high living standards in 2025, with an IMF-estimated GDP per capita (PPP) of about $34,100. After shuttering loss-making sugar estates in 2005, the federation pivoted to a three-pillar model: tourism, light manufacturing/assembly, and international financial services. Together, they account for around two-thirds to three-quarters of output and most foreign exchange. Cruise-ship and stayover arrivals have rebounded, cruise visitors rose in late-2024/early-2025, and a reformed citizenship-by-investment program has tightened due diligence and raised minimum investments.

Membership in the Eastern Caribbean Currency Union provides a stable EC dollar pegged at EC$2.70 to US$1, backed by strong reserves. On the supply side, industrial parks near Basseterre now focus on electrical/electronic components and beverages rather than the garment factories of earlier decades. Current strategy also emphasizes food-security initiatives and the energy transition, notably the Nevis geothermal project, moving toward drilling in 2026. Despite exposure to hurricanes and global travel cycles, solid reserves, ongoing hotel investment, and a resilient services base support SKN’s high per-capita income.

7. Costa Rica - $31,485 GDP/Capita (PPP)

Costa Rica enters 2025 with an estimated GDP-per-capita (PPP) of about $31,485, placing it among North America’s richer mid-sized economies. After shifting from coffee and bananas to a diversified services-and-high-tech export model, services now account for roughly 70% of GDP, while tourism, shared services, and medical-device manufacturing in free-trade zones drive exports. Flagship investors such as Intel, Abbott, and Amazon anchor a sophisticated corporate-services base that directly employs a low single-digit share of the workforce, helping keep real GDP growth around 3% despite high-single-digit unemployment.

Ecotourism remains a powerful foreign-exchange earner, leveraging the country’s 25% protected-land network and 98% renewable-electricity mix. Agriculture still supplies pineapples, coffee, and beef but only about 5-6% of GDP. Macroeconomic stability, with low single-digit inflation and a free-floating colón, is tempered by a public-debt stock around two-thirds of GDP and pressure on transport infrastructure, prompting gradual fiscal reforms and public-private investment drives to sustain long-term inclusive growth.

8. Antigua and Barbuda - $31,380 GDP/Capita (PPP)

Antigua and Barbuda is the 8th richest country in North America in 2025, with an IMF-estimated GDP per capita (PPP) of about $31,380. Tourism dominates the service-led economy, generating around 60% of GDP and most foreign exchange; cruise calls to St. John’s and high-end stays on the northwest coast supply the largest revenue stream. The U.S. is the largest source market (followed by the UK and Canada). A stable EC dollar peg (EC$2.70 = US$1), proximity to the U.S., and a reformed Citizenship-by-Investment program (now harmonized across the OECS with a US$200k minimum) sustain hotel construction and yachting marinas, while an offshore financial center and niche digital/telecom services add diversification. Manufacturing and agriculture remain small, hindered by scarce water and labor, but enclave plants export bedding, electronic components, and beverages.

Successive hurricanes since the 1990s have exposed infrastructure vulnerabilities, prompting fresh investment in resilient resorts, desalination, and renewable power. Assuming steady U.S. growth and no major storms, Antigua and Barbuda is set to maintain high living standards and moderate, tourism-led GDP growth through mid-decade.

9. Dominican Republic - $30,537 GDP/Capita (PPP)

Thanks to a decade of near-constant expansion, the Dominican Republic enters 2025 with an IMF-estimated GDP per capita (PPP) of about $30,500, among the Caribbean’s higher mid-tier incomes but below leaders such as The Bahamas, Trinidad & Tobago, and St. Kitts & Nevis. Growth has averaged roughly 5% since 2010, and the IMF sees 3% in 2025 before a return toward potential. Tourism remains the top foreign-exchange earner, generating $11B in 2024 from 11.19M visitors and a 90k-room hotel base.

Mining (anchored by the Pueblo Viejo gold mine) is a major export but is well short of tourism in FX terms. Free-trade-zone clusters (medical devices, electrical/electronics, pharmaceuticals) exported $8.4B in 2024, deepening diversification alongside growing BPO/telecom services. Agriculture is about 4-5% of GDP (avocados, cocoa, and bananas remain important). Remittances reached $10.76B in 2024, reinforcing consumption and small-business finance. FDI hit $4.5B in 2024, and an ongoing energy shift toward natural gas and renewables supports stability. Public debt sits around 59-60% of GDP, manageable under current conditions.

10. Saint Lucia - $29,257 GDP/Capita (PPP)

Now mainly a service hub, Saint Lucia enters 2025 with an IMF-estimated GDP per capita (PPP) of about $29,258. Services account for around 80-85% of GDP, led by tourism and a small offshore financial-services niche. Around a million total visitors (air + cruise) in a typical recent year support hotels, yachting, retail, and transport, providing the foreign exchange that underpins the EC-dollar peg (EC$2.70 = US$1). Light manufacturing/assembly, beverages, corrugated boxes, and electrical/electronic components, adds a single-digit share (7-10%), giving the island one of the broader industrial bases in the eastern Caribbean.

Agriculture, once dominated by bananas, now contributes about 3% of GDP but still a low-teens share of employment. Output has shifted away from bananas toward higher-value cocoa, mango, and avocado, while livestock and dairy schemes aim at import substitution. Investment-friendly incentives, reliable telecoms, and an educated workforce continue to attract firms, though structural unemployment remains in the low- to mid-teens. With tourism momentum and ongoing resilience investments, real GDP growth around 3% should keep Saint Lucia in the upper tier of Caribbean incomes in 2025, weather permitting.

Countries in North America Ranked by GDP/Capita (PPP)

| Rank | Country | GDP/Capita in USD (PPP) |

|---|---|---|

| 1 | United States | $89,598.86 |

| 2 | Canada | $65,500.25 |

| 3 | Panama | $43,651.39 |

| 4 | The Bahamas | $42,002.51 |

| 5 | Trinidad and Tobago | $35,899.58 |

| 6 | Saint Kitts and Nevis | $34,096.36 |

| 7 | Costa Rica | $31,485.04 |

| 8 | Antigua and Barbuda | $31,380.29 |

| 9 | Dominican Republic | $30,537.61 |

| 10 | Saint Lucia | $29,257.60 |

| 11 | Mexico | $25,770.39 |

| 12 | Barbados | $23,183.92 |

| 13 | Grenada | $21,414.45 |

| 14 | Saint Vincent and the Grenadines | $21,235.18 |

| 15 | Dominica | $19,381.06 |

| 16 | Guatemala | $15,100.09 |

| 17 | Jamaica | $13,924.09 |

| 18 | El Salvador | $13,876.77 |

| 19 | Nicaragua | $9,081.75 |

| 20 | Honduras | $7,955.75 |

Discover More Rich Countries

The Richest Countries In The World

Liechtenstein, Singapore, and Luxembourg are currently the three richest countries in the world for 2025, with a GDP/Capita in PPP of $201,112, $156,969 and $152,394.

The Richest Countries In Europe

Liechtenstein, Luxembourg, and Ireland rank as the three richest countries in Europe for 2025 with a GDP/Capita in PPP of $201,112, $152,394, and $147,878, respectively.

The Richest Countries In Asia

Singapore, Qatar and Brunei are currently the richest countries in Asia for 2025, with GDP/Capita in PPP of $156,969, $122,283, and $94,472, respectively.

The Richest Countries In South America

Guyana, Uruguay, and Chile are the richest countries in South America for 2025, with GDP/Capita in PPP of $94,189, $37,190, and $35,286, respectively.

The Richest Countries In Africa

Seychelles, Mauritius, and Gabon are the richest countries in Africa for 2025, with GDP/Capita in PPP of $42,110, $33,023, and $24,738, respectively.

The Richest Countries In South Asia

The Maldives, Bhutan, and India are the richest countries in South Asia for 2025, with a GDP/Capita in PPP of $36,065, $17,721, and $12,100, respectively.